Best Accounting Software for Small Businesses

On our ranking of the best accounting software for small businesses, QuickBooks Online takes first place.

Through our own independent research, with out influence of advertisements, we thoroughly evaluated the accounting software's available for small businesses in order to determine which accounting software would be considered the best for small businesses. We hope our findings help you choose which accounting software is best for you and your small business.

Accounting software assists owners of small businesses in keeping track of their accounts receivable and accounts payable, gaining a transparent comprehension of their profitability, and improving their level of readiness for tax season. Accounting software that is "out of the box" can frequently be used by small enterprises and does not require considerable customization in most cases. It is common for a growing company to require a bespoke enterprise resource planning (ERP) system to accommodate its increasingly intricate accounting needs as the company expands.

After conducting research and making comparisons on more than 15 different accounting software companies, we chose the top five that are most ideally suited for small businesses. We looked at different functionality for different industries, things like price tags, capabilities, and how well they fit the market. For instance, a information technology company's requirements are not going to be the same as those of a construction company. The following are the best accounting software packages that we recommend for small businesses.

Our Selection for The Best Accounting Software for Small Businesses

- QuickBooks Online

- QuickBooks Self-Employed

- Wave

Accounting Software - QuickBooks Online - Overall Best Option

Why Small Businesses Should Choose QuickBooks Online

Not only do the majority of accounting professionals who work for small businesses utilize QuickBooks Online, but there is also an unending supply of training resources and QuickBooks consultants available to provide support when it's required. The ability to access all accounting elements in a centralized location on a single dashboard makes the process of bookkeeping more streamlined and effective.

Accounting Software Pros

- QuickBooks is Scalable

- Utilized frequently by financial and accounting experts.

- QuickBooks Integrates with a long list of apps developed by other companies.

- Cloud-based

- A mobile app is available.

Things to Remember

- QuickBooks updates due to a large subscriber base.

An Overview of the QuickBooks Accounting Software

Intuit's QuickBooks Online is one of the accounting software systems that has become the most popular choices for usage by small businesses and the bookkeeping and tax professionals who serve them. A web browser or an application on a mobile device can be used to gain access to the software that is hosted in the cloud.

Following the free trial period of 30 days, QuickBooks has four different options for monthly membership plans: Simple Start, Essentials, Plus, and Advanced. In most cases, the initial few months of a subscription are available at a substantial savings.

The monthly subscription for this accounting software program may be increased as a company expands, and the mobile app that can be used to receive payments, check reports, take a picture of a receipt, and track business mileage comes with a wide variety of configuration possibilities. QuickBooks Payroll is a system that fully integrates with QuickBooks Online and is available to businesses that are searching for a payroll solution.

Each plan comes with increasingly sophisticated capabilities, such as cash flow monitoring, inventory management, time tracking, and additional users. The vast majority of small service-based businesses will discover that Simple Start satisfies all of their requirements. Essentials or Plus will have more options for inventory and modifications available for product-based small enterprises than Basics will. The Advanced membership is a brand-new option that gives users access to robust financial reporting. This financial report analysis tool is known as Fathom. It is utilized by many large businesses worldwide.

Integration with third-party applications like Stripe and PayPal is available across all pricing tiers. The app store for QuickBooks Online organizes all of its available apps in accordance with their respective functions and provides informative samples of the advantages offered by each program.

Accounting Software - QuickBooks Self-Employed

Why QuickBooks Self Employed?

This is our top recommendation for freelancers and independent contractors working part-time who are primarily concerned with keeping track of their income and expenses for their annual tax return. It automatically tallies up all of the business transactions, and it is developed specifically for those who own businesses and file a Schedule C as part of their individual tax filings.

QuickBooks Accounting Software Pro's

- Cloud-based

- Mobile app available

- Monitors mileage.

- Makes a distinction between corporate expenses and individual costs.

- Compatible with TurboTax

Things to Remember

- Data migration to another accounting software is not done in an easy manner.

- Reporting restrictions

An Overview of QuickBooks Self Employed Accounting Software

Intuit's QuickBooks Self-Employed is a business accounting software solution that features both a web-based interface and a mobile app. This software was developed to assist freelancers in maintaining an organized filing system each year in preparation for tax time. Tracking mileage, categorizing spending, managing receipts, and calculating and filing taxes through a smooth integration with TurboTax are some of the features included in QuickBooks Self-Employed.

Customers have the choice to select from three plans. Some discounts are available for the first three months of membership. Both of these tax bundles come with a year's worth of filing your taxes with TurboTax included.

The smartphone app makes it simple to keep track of one's logged miles while driving and to photograph receipts for reimbursement of business expenditures. The vast majority of accounting software is not designed to differentiate between personal and company transactions; nevertheless, one of the unique features of QuickBooks Self-Employed is the provision of an option to label each transaction as either personal or business-related. Freelancers who do not have a bank account that is specifically designated for their business activities will find this to be helpful.

Accounting Software - Wave

Why Wave Accounting Software?

Wave is the accounting software platform that is best suited for use by a small service-based company that only needs to send out basic invoices and does not need to process payroll. Accountants are able to obtain the appropriate reports from Wave at the end of the fiscal year in order to complete a company's tax return.

Pros

- Accounting, invoicing, and receipt scanning at no additional cost

- There are no limits placed on transactions or invoices.

- Maintain several companies using a single login.

- An unlimited amount of users are permitted.

- Mobile app available

Cons

- Zapier is the only platform supported for integrations.

- Payments made with credit cards and ACH will incur higher fees.

- There are only 14 states where full-service payroll is available.

The foundational accounting features that most small businesses need, such as income and expense tracking, financial reporting, invoicing, and scanning receipts, are all included with this free software. These features can be accessed online or on the mobile app. Customer payment processing and payroll are considered premium services that cost extra, but all bookkeeping, invoicing, and reporting features are completely free.

Wave makes its money on its payment gateway. To process payment from a customer, Wave charges 2.9% plus 60¢ per transaction for Visa, Mastercard, and Discover, and 3.4% plus 60¢ per transaction for American Express. These fees are slightly higher than other accounting software. Additionally, to process an ACH payment, rather than a credit card, Wave charges 1% per transaction with a $1 minimum fee.

Wave offers two payroll plans as an add-on service. The first plan is $20 per month plus $6 per employee or contractor. In this plan, Wave will process payroll and prepare payroll tax calculations, but the user is responsible for manually completing payroll tax forms and submitting tax payments. The second plan is $35 per month plus $6 per employee or contractor. In this plan, payroll is full-service, which means that all tax filings and payments are completely managed by Wave. This full-service payroll option is only available in 14 states.

In Conclusion about Accounting Software for Small Businesses

Accounting software helps small businesses with a variety of tasks, including the management of their costs and the preparation of their tax returns. Nonetheless, every company is unique in its own way.

The scalability of QuickBooks Online, along with its extensive training resources and mobile app, earned it the #1 spot not just on our list but in many reviews. If QuickBooks isn't the right choice for your small business, you're sure to find a good fit with one of our other options, such as Zoho Books, Wave (for a free or lower-cost solution), or QuickBooks Self-Employed (if you're an independent contractor).

If you need more information - please contact PNATC or you can book a free consult online. Our Accounting Software Experts can properly advise you as to the right accounting software for you and your business needs.

Accounting Software for Small Business FAQs

What Does Accounting Software Do for a Small Business?

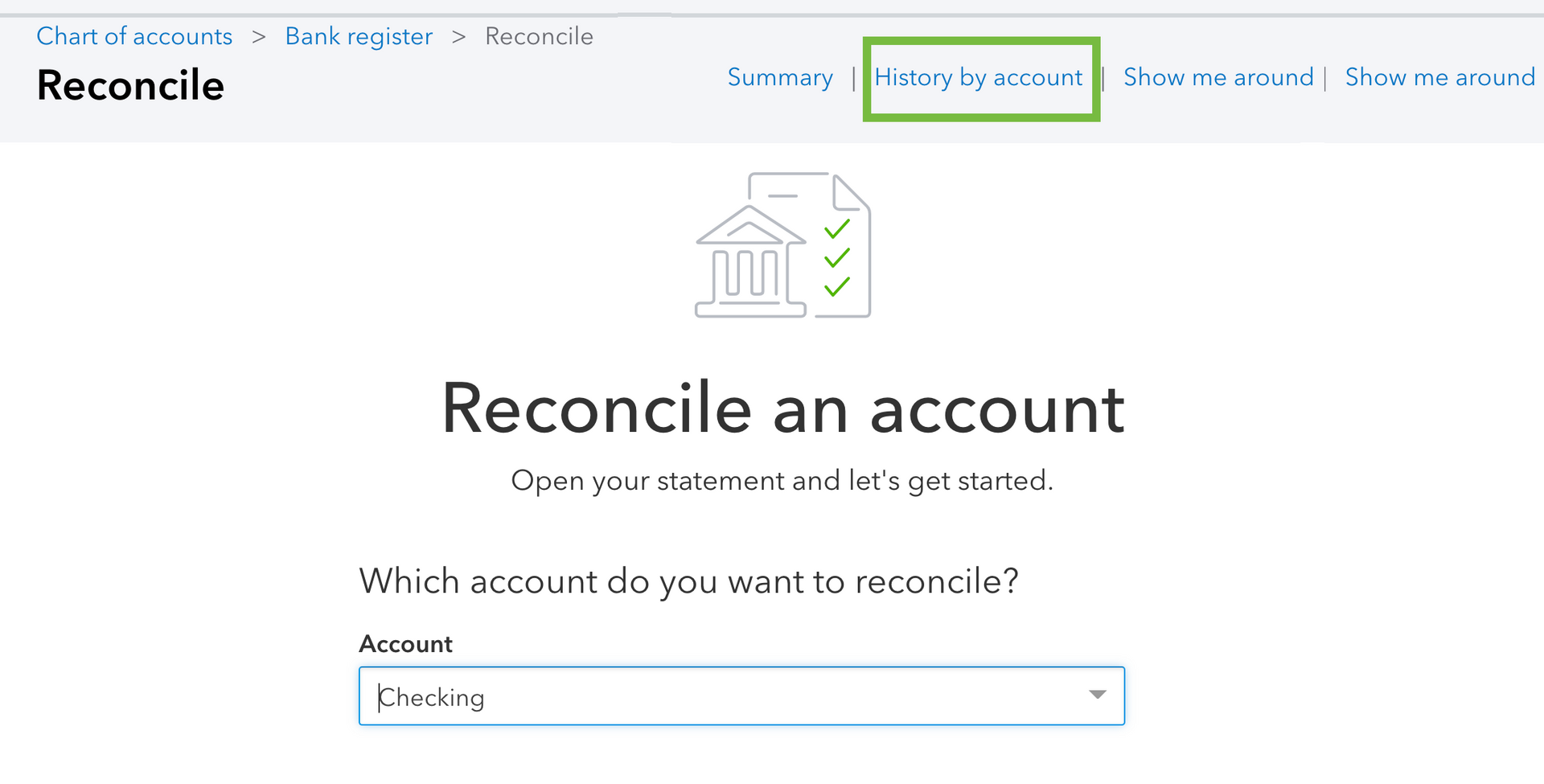

After the bank accounts and credit cards of a company have been synchronized with the accounting software, transactions will begin to appear in a queue and will be able to be categorized according to the headings that are located on the company's chart of accounts. After the appropriate category has been selected, the transactions will be populated into the company's financial statements. A financial report can be generated in a matter of seconds for owners of businesses to analyze profitability, compare revenue and costs, verify bank and loan balances, and forecast tax liabilities. The ability to quickly access this financial information provides owners of businesses with the ability to make crucial decisions.

In addition, most accounting software enables the integration of applications developed by other parties. For instance, if a business owner records sales transactions using a point of sale (POS) system, then the POS system could potentially integrate with the accounting software to record specific transactions, sales tax liabilities, sales by subcategories, and more. This would be possible if the POS system was designed to do so. In a company that provides services, a time-tracking application may be able to link with the company's accounting software in order to add labor to an invoice for a customer.

What Does Accounting Software Do for a Small Business?

By enabling users to synchronize their corporate bank accounts and credit cards with the accounting software, customers are able to significantly cut down on the amount of time spent on data entry. After the synchronization is complete, the transactions will begin to flow into the accounting software, where they will be able to be sorted into the appropriate accounts. Even though the majority of accounting software is clear to operate, users nonetheless need to have a fundamental comprehension of accounting concepts in order to generate accurate financial reports. For this reason, many firms choose to outsource the task of maintaining or analyzing their books to professional bookkeepers or accountants. Accounting software that is hosted online and accessible through the cloud makes it easy for companies to give their bookkeepers and accountants simultaneous access to their company's financial records.

The following is a list of the most fundamental capabilities of accounting software for small businesses:

- Invoicing

- Syncing of financial accounts and credit cards

- Payables to creditors

- Receivables from accounts

- Customers' payments are collected via the internet.

- Preparation of fundamental financial statements, including profit-and-loss statements, balance sheets, and cash flow statements

- Access for accountants and other tax specialists to the user interface

How much does small business accounting software cost?

The monthly cost of small business accounting software can range. Basic plans are a wonderful place to start and typically cost between $0 and $40 per month. A small firm will be able to categorize income and expenses, send invoices, and create financial reports with the help of a basic plan. Most accounting software is scalable as a business expands, and the strategy may be quickly changed to accommodate new business requirements. The more comprehensive plans give businesses the ability to manage payroll, create more specialized financial reports, track inventory, and select from a wider range of invoicing alternatives.

Leave a Reply

Contact PNATC

Contact - Website lead

We will get back to you as soon as possible.

Please try again later.

Recent Posts

Share Post

Contact PNATC

Get all your questions answered and problems solved with our QuickBooks experts today!

Contact Information

(203) 489-9887

Office Locations

225 W 35th St, Suite 5B New York, NY 10001

350 Bedford St., Suite 303 Stamford CT 06901

About PNATC

QuickBooks

QuickBooks Services

All Rights Reserved | PNATC | Privacy Policy | Terms and Conditions